Value Added Tax (VAT) is one of the taxes you pay as a consumer in Nigeria. It is a consumption tax that you pay on goods and services that you purchase in Nigeria. The VAT rate in Nigeria at the time of writing this article is 7.5%. You can’t just tax any item however as some items are exempted from VAT.

Collecting VAT from your customers also isn’t meant for you to boost your revenue as a business owner or service provider but for you to remit to the Federal Government during your tax returns filing. You also don’t need to bother about VAT if your annual turnover is below twenty-five million Naira (25,000,000)

Although VAT is recommended for all business owners and service providers in Nigeria, only a few people know how to calculate and add the right VAT to their customers’ invoices/orders. In this article, I will guide you on the steps to take to calculate VAT when you create an invoice for your customers.

1. Sum all the goods/services your customer ordered

You can only calculate VAT when you know the total of your customers’ orders. A calculator or Excel sheet will be helpful here. For instance; you run an online fashion shop, and a customer orders the following;

Bag 50,000

T-Shirt 4,000

Sunglasses 10,000

Beanie 5,000

Total 69,000

2. Multiply the total of goods/services by 7.5 and divide by 100

I mentioned earlier in the article that VAT is 7.5%, so to get an accurate VAT rate, multiply the total of your goods/services by 7.5 and divide your answer by 100. Check the example below for clarity.

69,000 x 7.5/100 = 5,175

The VAT for the order in Step 1 is 5,175.

3. Add VAT to the total of your order

The next thing you need to do is to add whatever figure you get from step 2 to the total value of all the items in your customers’ order. See example below;

Bag 50,000

T-Shirt 4,000

Sunglasses 10,000

Beanie 5,000

Total 69,000

VAT (7.5%) 5,175

Grand Total 74,175

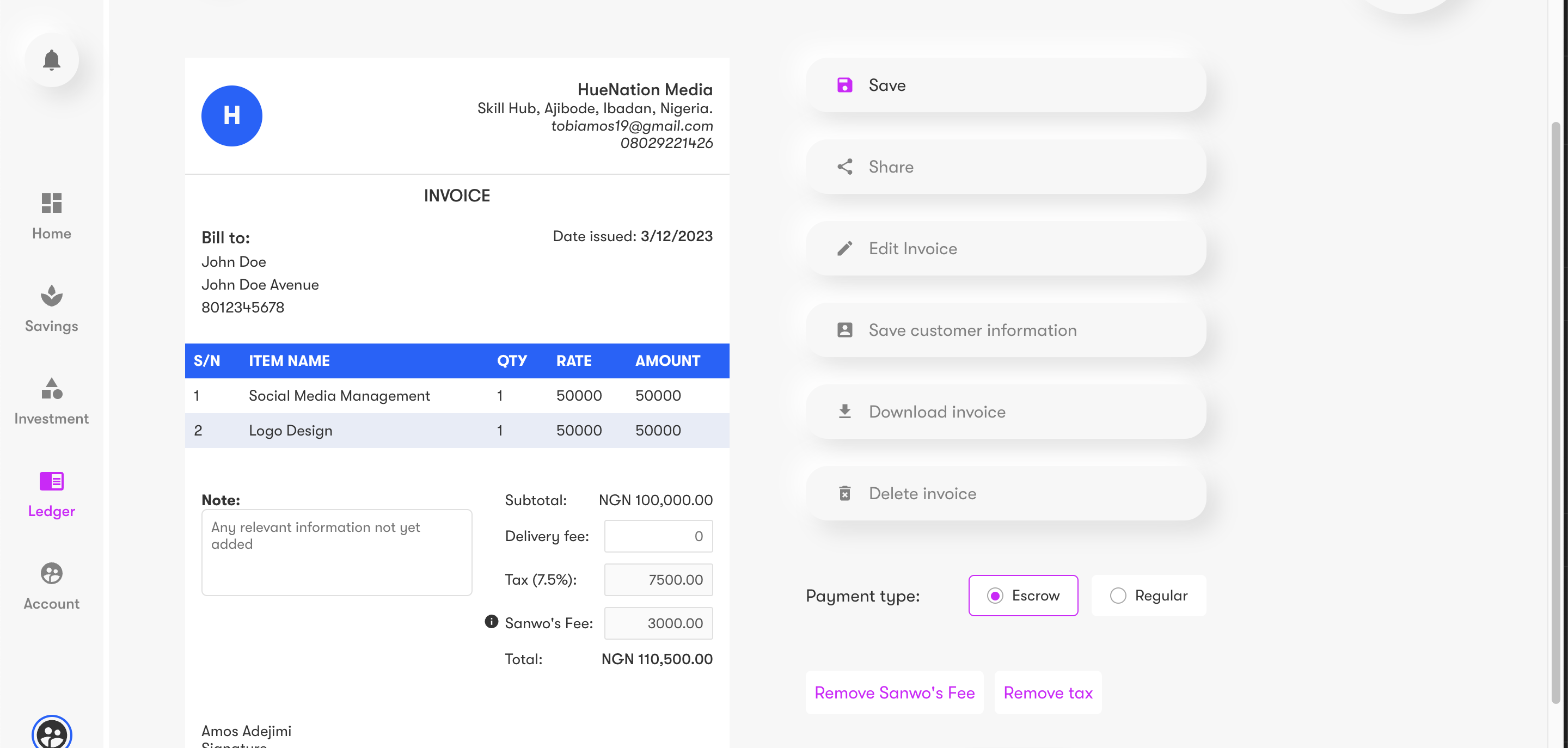

4. You can skip steps 1, 2 and 3 and just use Sanwo to calculate VAT automatically

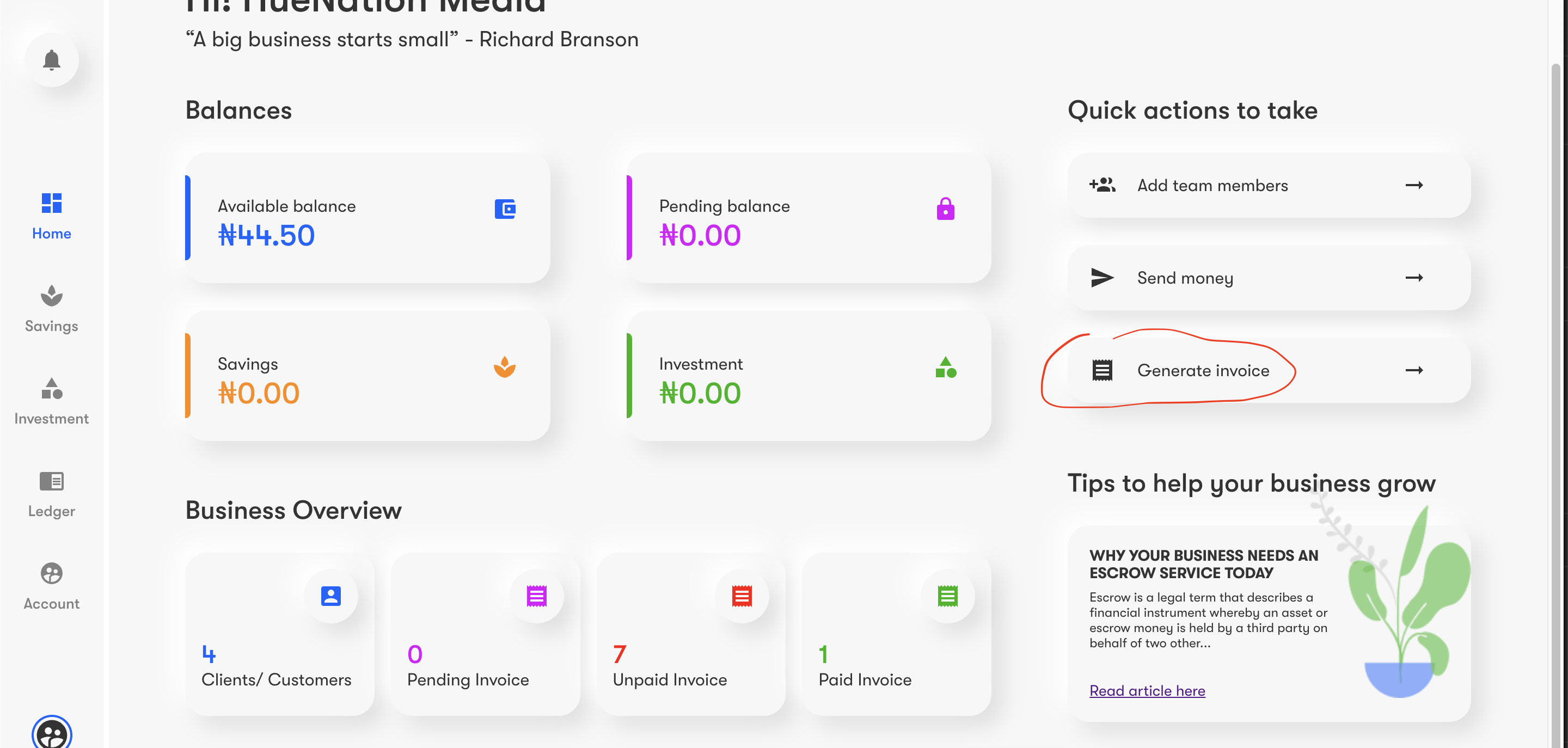

You’ll probably spend more time trying to use the steps above and who has time? When you create invoices on Sanwo, you can automatically add VAT thereby saving you and your business a lot of time.

- Log in to your Sanwo Account

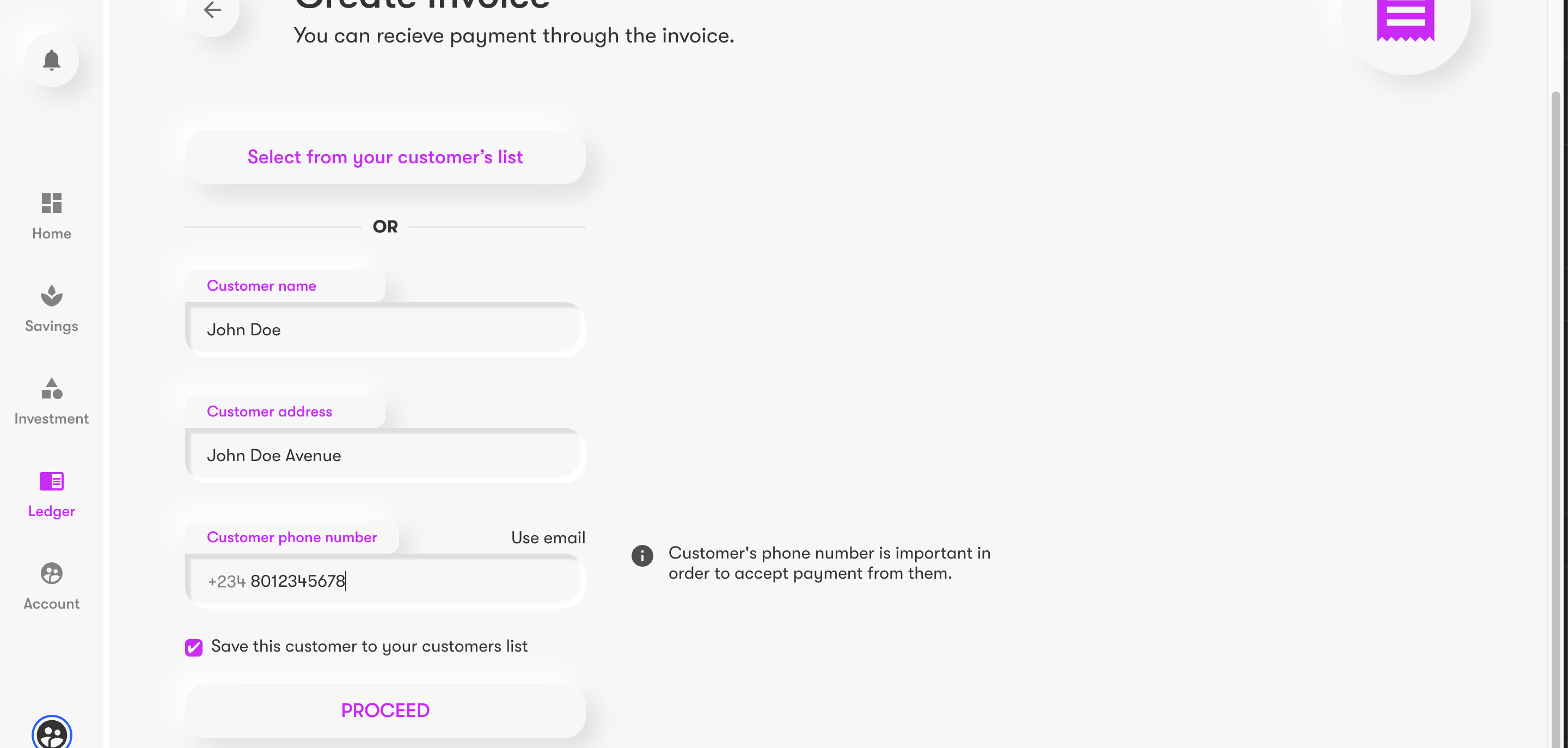

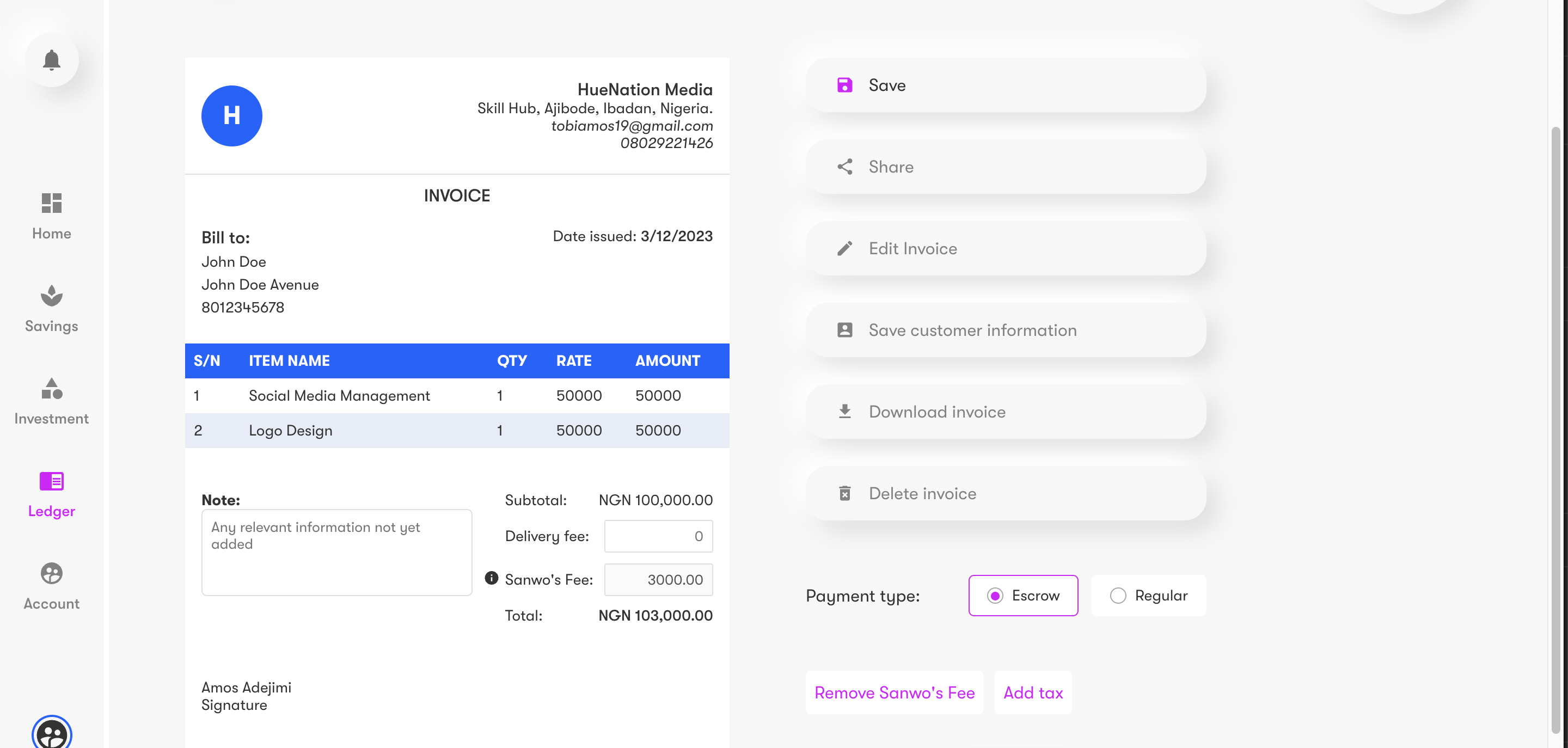

- Generate an invoice and add all the items your customer ordered.

3. Click on the “Add tax” button to add VAT to your customer’s order.

4. Share the invoice with your customer.

5. Repeat

You can use this feature on your mobile device too.

Do you find this article educative and would like to get more articles like this?

Sign up on Sanwo or follow us on our social media pages. Have fun calculating VAT and making profits from your business. 🤗